Mastering options trading with candlestick patterns involves comprehending market dynamics, trend analysis, support/resistance levels, breakouts, technical tools, risk management, trade evaluation, adaptive strategies, and utilizing candlestick insights for success. By understanding patterns like doji, hammer, and engulfing, traders can interpret sentiment and anticipate price movements effectively. Identifying trends, utilizing tools such as moving averages, and applying risk management strategies are essential. Evaluating trade outcomes, adapting to market shifts, and leveraging candlestick patterns can greatly enhance trading performance. This knowledge opens doors to informed decision-making and effective trade setups, leading to improved trading outcomes and success.

Understanding Candlestick Patterns

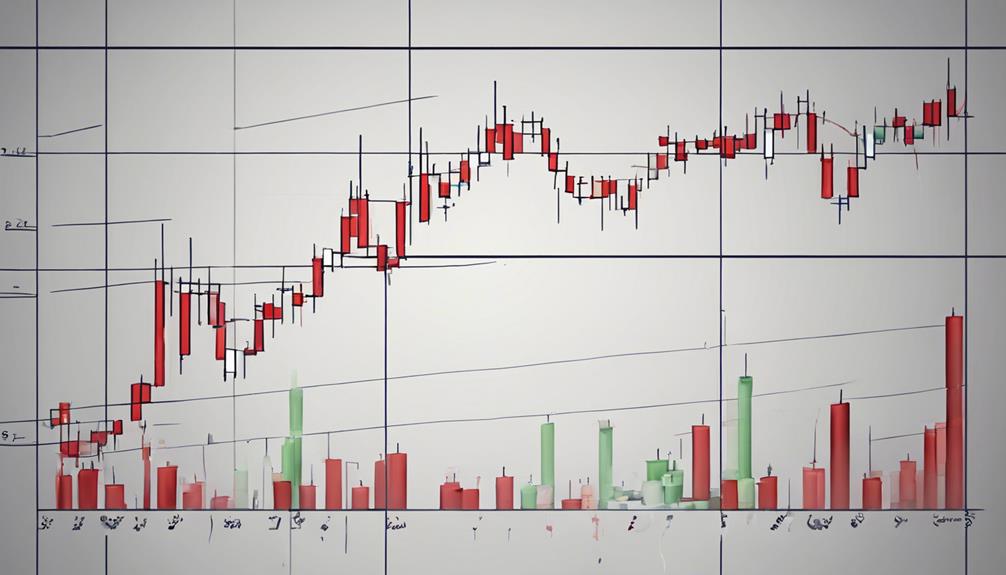

Candlestick patterns serve as essential visual representations of market price movements, offering valuable insights into investor sentiment and potential future price direction. These patterns are a fundamental aspect of technical analysis, providing traders with a way to interpret market behavior based on historical price data. By studying common candlestick patterns such as doji, hammer, engulfing, and harami, traders can gain a deeper understanding of market dynamics and potential trend reversals.

Technical analysis, which incorporates the study of historical price data to forecast future price movements, is enhanced by the recognition and interpretation of candlestick patterns. Understanding the significance of these patterns can help traders identify key market turning points, establish entry and exit points for trades, and manage risk effectively. By integrating candlestick analysis into their trading strategies, traders can make more informed decisions and potentially improve their overall trading outcomes in the options market. Recognizing the patterns and their implications can provide traders with a competitive edge in maneuvering through the complexities of the financial markets.

Identifying Market Trends

Analyzing market trends involves studying the direction of price movements to gain insights into asset behavior. By categorizing trends as uptrend, downtrend, or sideways, traders can anticipate potential market movements.

Utilizing tools like moving averages and trend lines aids in accurately identifying and interpreting market trends for effective trading strategies.

Trend Identification Techniques

Effectively identifying market trends is essential for traders seeking to make informed decisions and optimize their trading strategies. Traders rely on various techniques such as moving averages, trend lines, and support/resistance levels to determine market trends accurately. Utilizing these tools can help traders align their strategies with the prevailing market conditions, leading to more successful trades. Below is a table highlighting the importance of trend identification techniques in trading:

| Trend Identification Techniques | Description | Benefits |

|---|---|---|

| Moving Averages | Smooth out price fluctuations | Identify trend direction |

| Trend Lines | Connect peaks and troughs | Determine trend strength |

| Support/Resistance Levels | Price levels where trends halt | Signal potential reversals |

Market Trend Analysis

In options trading, a key aspect for traders to navigate effectively is the ability to accurately identify market trends through thorough market trend analysis. Market trend analysis involves recognizing the current market direction, whether it is an uptrend, downtrend, or sideways movement. Traders utilize tools like candlestick patterns, trend lines, moving averages, and price action to confirm trends.

Understanding market trends aids traders in making well-informed decisions regarding trade entries, exits, and position management. By analyzing market trends, traders can gain insights into potential reversal zones and identify support/resistance levels for strategic trading.

Successful traders incorporate market trend analysis, including candlestick patterns, into their trading strategies to align with the prevailing market direction, enhancing the probability of successful trades.

Key Support and Resistance Levels

When traders identify key support and resistance levels in a stock's price movement, they gain valuable insights for strategic decision-making. Key support levels act as a price floor, where the stock tends to find buying interest and reverses its downward trend. On the other hand, resistance levels act as a price ceiling, where the stock faces selling pressure and struggles to move higher. By pinpointing these critical levels on a price chart through trend analysis using historical data, traders can effectively plan their entry and exit points, as well as set appropriate stop-loss levels to manage risk.

Understanding key support and resistance levels is fundamental in trading. Breakouts above resistance or breakdowns below support can signal potential trading opportunities. Breakouts suggest increasing bullish momentum and may indicate a good time to enter a long position. Conversely, breakdowns below support levels could signal a weakening trend and potentially offer a chance to enter a short position. By incorporating these levels into their trading strategies, traders can enhance their decision-making process and improve their overall trading performance.

Clear Breakout Signals

Clear breakout signals in candlestick patterns serve as reliable indicators for identifying potential trade opportunities with a high probability of success. Breakouts from key support or resistance levels often lead to significant price movements in the direction of the breakout. Utilizing these signals effectively in trading strategies can enhance profit potential and risk management. Confirmation of breakout signals is vital before entering a trade to filter out false signals and improve accuracy. Breakout candlesticks accompanied by strong volume support are considered more reliable for trade execution. Incorporating trend lines and breakout points can further strengthen trade setups and promote better risk management in options trading.

| Key Points | Benefits |

|---|---|

| Reliable trade indicators | Increased success rate |

| Potential for significant price movements | Enhanced profit potential |

| Confirmation essential for accuracy | Reduced false signals |

| Strong volume support | Reliable trade execution |

| Trend lines and breakout points | Improved risk management |

Technical Analysis Tools

Utilizing technical analysis tools in options trading equips traders with the necessary insights to identify trends, support/resistance levels, and ideal entry/exit points for informed decision-making. These tools, such as trend lines, moving averages, and chart patterns, play an essential role in analyzing market movements and making strategic trading decisions. By recognizing key candlestick patterns and utilizing these technical indicators, traders can better understand market sentiment and predict potential price directions.

Moreover, technical analysis tools not only enhance the ability to predict market movements but also aid in improving trading strategies. They provide traders with a systematic approach to analyzing market trends, which is vital for effective risk management. By incorporating these tools into their trading arsenal, traders can mitigate risks and capitalize on profitable opportunities in the options market. Mastering the use of technical analysis tools is therefore paramount for traders seeking to optimize their trading performance and achieve long-term success in options trading.

Risk Management Strategies

Effective risk management strategies in options trading are crucial for safeguarding investments. Position sizing techniques and strategic stop loss placement play a key role in this process.

Determining the appropriate position size based on risk tolerance and market conditions enables traders to mitigate potential losses. Placing stop losses at key levels helps limit downside risk and protect capital, especially in volatile market environments.

Position Sizing Techniques

Implementing proper position sizing techniques is vital in options trading to effectively manage risk and protect capital. When incorporating candlestick patterns into trading decisions, position sizing based on risk tolerance and account size becomes essential.

Utilizing a percentage of the account balance or following risk management strategies like the 1% rule can help prevent substantial losses. By adjusting position sizes according to market conditions and trade setups, traders can enhance their risk-reward ratios. This approach not only safeguards capital but also promotes trading discipline, reduces emotional decision-making, and fosters consistency in overall performance.

Adhering to sound position sizing methods empowers traders to navigate the complexities of options trading with a structured and controlled approach.

Stop Loss Placement

Proper placement of stop losses is a critical component of risk management in options trading that safeguards against potential losses. When setting stop loss levels, traders should conduct thorough market analysis, considering factors such as volatility, support/resistance levels, and overall market conditions.

Utilizing technical analysis tools can assist in determining the best placement for stop loss orders. By implementing disciplined stop loss strategies based on market analysis, traders can protect their capital and enhance their trading performance.

Stop loss orders automatically trigger the sale of an option at a predetermined price, helping to limit downside risk. Incorporating these risk management practices into options trading can contribute to a more structured and successful trading approach.

Evaluating Trade Outcomes

Regularly evaluating trade outcomes in options trading is essential for gaining valuable insights and improving future performance. Analysis of trade outcomes allows traders to learn from both wins and losses, providing a deeper understanding of the effectiveness of their decisions in relation to market movements and results.

By considering the impact of market conditions on trade outcomes, traders can make informed adjustments for future trades. Reviewing the success of trades involves examining how well they align with market analysis and strategies, enabling traders to refine their approach.

These evaluations provide valuable insights that can be used to enhance future trading performance and optimize strategies. By consistently analyzing trade outcomes, traders can adapt to changing market dynamics and make well-informed decisions that align with their goals and risk tolerance.

Evaluating trade outcomes is a vital step in the continuous improvement process for options traders seeking to maximize their success in the market.

Adapting to Market Dynamics

Mastering the intricacies of options trading demands a sharp ability to adapt to ever-evolving market dynamics. Adapting to market dynamics is essential for success in options trading. Here are key points to ponder:

- Adjusting Trade Strategies: Adapting to market dynamics involves modifying trade strategies based on changing trends and conditions. This flexibility allows traders to maneuver varying market scenarios effectively.

- Identifying Entry and Exit Points: Understanding market dynamics helps in pinpointing ideal entry and exit points for trades. By analyzing market trends and shifts, traders can make well-informed decisions.

- Continuous Monitoring: Flexibility in adapting to market dynamics is vital. Traders need to consistently monitor price action and key levels to make timely and well-informed trade decisions. This proactive approach enhances the ability to capitalize on market opportunities and minimize risks associated with changing market conditions.

Being attuned to market dynamics is fundamental for successfully mastering the complexities of options trading.

Enhancing Trading Success

Enhancing trading success in options involves leveraging the insights gained from understanding key candlestick patterns. Candlestick patterns serve as powerful indicators of market sentiment and potential price movements, offering traders valuable information for making informed decisions. By recognizing and interpreting these patterns, traders can enhance their trade setups, identify entry and exit points with greater precision, and adapt more effectively to market dynamics in options trading.

Successful options trading often hinges on the ability to spot relevant candlestick patterns that signal trend reversals or continuation opportunities. Utilizing these patterns not only improves decision-making but also aids in managing risks more effectively. Traders who master the art of reading candlestick patterns can significantly increase their profitability and navigate the complexities of the options market with more confidence.

In essence, incorporating candlestick patterns into trading strategies is a cornerstone of enhancing trading success in options. By honing this skill, traders can gain a competitive edge and optimize their performance in the dynamic world of options trading.

Frequently Asked Questions

Which Candlestick Pattern Is Most Reliable for Option Trading?

When evaluating candlestick patterns for option trading, pondering candlestick psychology is essential. Among various patterns, the most reliable for option trading is often the bullish engulfing pattern. This pattern signifies a potential reversal of a downtrend, offering traders a strong signal to contemplate bullish positions.

Understanding the implications of candlestick patterns in the context of market psychology can enhance decision-making in options trading strategies.

Do Professional Traders Use Candlestick Patterns?

Professional traders leverage candlestick patterns to decode market sentiment and predict price movements. By understanding candlestick psychology, traders can anticipate potential reversals or trend continuations.

These visual cues aid in identifying entry and exit points with greater precision, enhancing trading strategies' effectiveness. Incorporating candlestick patterns into their analysis allows traders to make informed decisions based on historical price patterns, ultimately improving their overall trading performance.

What Is the Most Powerful Candlestick Pattern?

The most powerful candlestick pattern, based on candlestick psychology, is the Hammer. This pattern signifies potential trend reversal with a small body at the top and a long lower shadow, indicating bullish momentum.

Traders often seek Hammers at downtrend bottoms for buying opportunities, as they suggest a shift in control from sellers to buyers. Confirming this pattern with subsequent price action is essential for effective trading decisions.

How to Read Candlesticks for Options Trading?

To read candlesticks for options trading, one must grasp the nuances of candlestick analysis. Analyzing candlestick patterns involves interpreting the relationship between open, high, low, and close prices to gauge market sentiment.

Conclusion

To wrap up, acquiring proficiency in the art of options trading with candlestick patterns necessitates a deep understanding of market trends, support and resistance levels, breakout signals, technical analysis tools, risk management strategies, trade evaluation, and market dynamics adaptation.

By honing these skills and strategies, traders can enhance their success in maneuvering through the complexities of the options market. Remember, Rome wasn't built in a day, and neither is expertise in options trading.